Excitement About DOR: Bankruptcy Forms - IN.gov

Unknown Facts About Bankruptcy - Georgia Department of Revenue

A concern financial obligation is a debt that normally survives personal bankruptcy. Typical types of priority financial obligation consist of child support, specific types of taxes, and other financial obligations the US Personal bankruptcy Code attends to special treatment. Similar to the other forms of debt, maintaining a copy of your bankruptcy records can be helpful if you require proof of your insolvency court records.

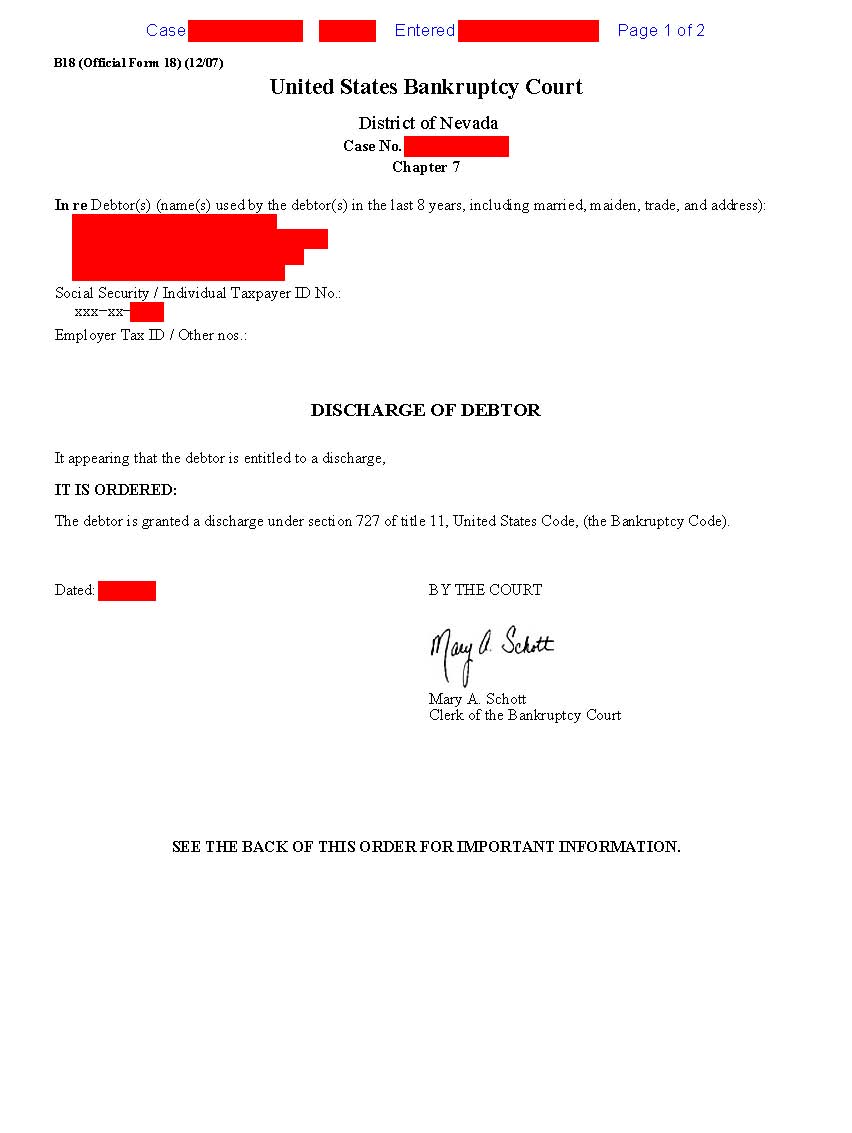

Your personal bankruptcy discharge order provides you the confirmation that your case is now closed and all of the debts included are non-enforceable. As a result, creditors noted in the bankruptcy petition can no longer contact you about your debts or file an action against you for collection. You need to keep all of these insolvency files because of your requirements to provide them if you get an undocumented loan later on.

That is still readily available. You need to keep your insolvency discharge order in a safe location due to the fact that life takes place, and an insolvency discharge order and other insolvency records can get lost. Therefore, a Debtor needs to constantly maintain a copy of their insolvency court records. Years after you file your petition, you may need to see what financial institutions were included in your filing.

Get Copies of Your Bankruptcy Discharge Papers - Bankruptcy Records

What Does Discharge in Bankruptcy - Bankruptcy Basics Mean?

There are numerous methods to get a copy of your personal bankruptcy discharge order and associated paperwork. The simplest method would be to connect to the lawyer or law firm that submitted your personal bankruptcy petition. Likewise, you can get in touch with the clerk of courts for the bankruptcy court where you submitted your case.

Obtain copy of bankruptcy discharge papers -

Bankruptcy Discharge Papers-Obtain Copies for $5 - YouTube

A PACER account will provide you access to electronic court records filed in your case. Ask the lawyer or law firmthat filed your case to get you a copy of your bankruptcy discharge and other personal bankruptcy records Numerous lawyers keep their customer's personal bankruptcy records for numerous years prior to shredding them.

Typically an attorney will supply a copy for free for existing customers. If they can not locate the file, they may use an electronic terminal to print out the product. chapter 7 discharge of personal bankruptcy lawyers charge a small fee for these records. All personal bankruptcy attorneys have access to PACER and can print any personal bankruptcy petition and discharge.